Through our relationship with Fidelity, GWN advisors have the ability to assist clients with opening HSA accounts.

For information on Fidelity HSA Program, please click on the link: https://www.fidelity.com/go/hsa/why-hsa

Opening a Health Savings Account (HSA) at GWN:

Investment Options

- $10,000 Minimum

- Refer to the Non-Qualified (Mutual Fund FIWS Custodian) Fund Choice List available in the Fund Choice Lists section of the MAP page on the website.

- Ensure a minimum of 3 Funds are included in the allocation for investments.

Verify Fidelity Setup

- Ensure you have a Fidelity G#

- If you do not have one, contact the GWN Internal Platforms Department for assistance to complete the setup before submitting the application.

Complete the Required Paperwork

- Complete both:

- HSA Application

- GWN Premier & MAP ETF Non-Qualified on FIWS Short Kit

- Visit the FIWS website → Forms Library tab → Search “Health”

- Note: The application requires a wet signature

Fee Structure and Compensation

- The maximum annual client fee is 2%

- Advisor compensation is based on your standard MAP rate.

Work with clients who have state level and/or ERISA plan level accounts during their active employment years. Manage your clients’ 401(k) and 457 accounts while they are contributing. These companies may help you strengthen the client relationship through advisory management on Plan Level Assets within a Self-Directed Brokerage Account.

Colleges and Universities around the country have traditionally been under-served areas for retirement savings education for their employees. Through a special arrangement, advisors could now be offering...

Through a special arrangement, advisors could now be offering participants of higher education around the country a unique opportunity to benefit directly from independent active management within their retirement account.

- Assetmark

- Verity Asset Management

Approved Separately Managed Account providers for custom portfolio design, direct and bond modelling, high-net worth clients solutions as well as Solicitor Management Arrangements.

- Castellum Asset Management

- Howard Capital

- Mariner

The following are Third Party Asset Management Platforms (TAMPs) available through GWN's RIA guidelines and relationship in which approved advisors may find a variety of managed solutions.

- AssetMark

- Flexible Plan

- Lockwood

- Managed 360

- Orion Portfolio Systems

- Pine Valley Investments

- SEI

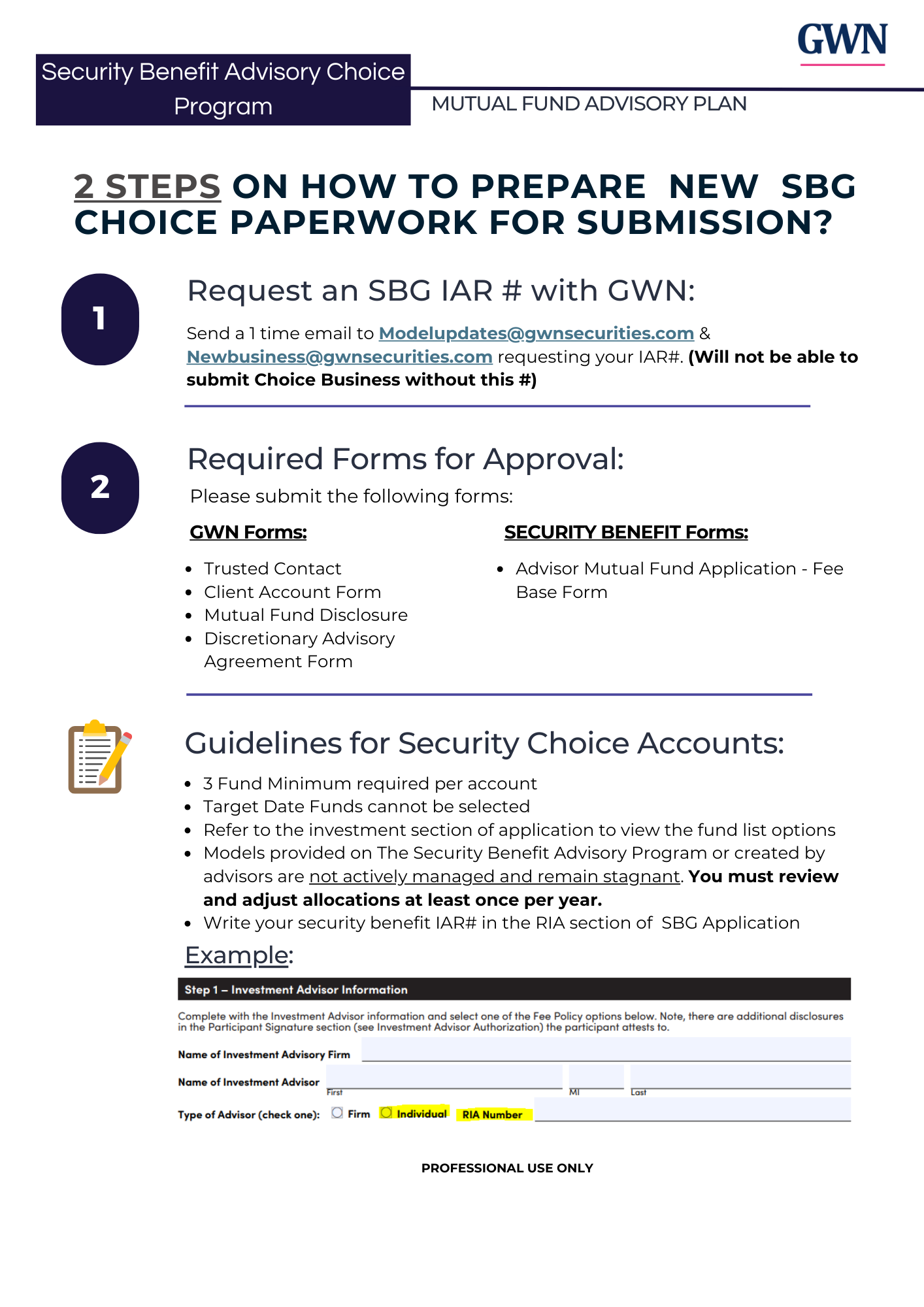

GWN, in collaboration with Security Benefit, is now providing GWN's advisors with the opportunity to customize their allocations within the Fee-Based Option of the Security Benefit Advisor Mutual Fund Program.

Advisors can tailor investment portfolios to better meet the specific needs and objectives of their clients. For additional questions, please email bonny.cassella@securitybenefit.com

Please click here to access the Fee-Based Security Benefit Advisor Mutual Fund application: https://www.securitybenefit.com/financial-professionals/product/advisor-mutual-fund-program

Please Note:

- Transfers or exchanges from existing Security Benefit accounts are not permitted in this program. It is available for new accounts only.

Compensation:

- 20bps platform fee - remaining fee goes across the grid

SBG Advisory Choice Platform Webinar:

Please refer to the information below for guidance on submitting business and account restrictions: